Using Target Date Funds in your Alaska Employer Retirement Plan

Target date funds are a simple and effective solution for many employees investing in their state of Alaska defined contribution plan. Read on to discover how target date funds have evolved to work with your employer retirement plan and pitfalls to avoid for more customized situations.

The Employee Investor Problem

The first and often only experience many people have with retirement investing is through their employer retirement plans. At its inception, Alaska teachers and public employee retirement plans primarily provided pension payments, determined by the employer’s defined benefit plan. In the 2000’s many employers started shifting the burden of investment decisions onto the employee by moving to a defined contribution approach for new plan members, and the State of Alaska was no exception. Defined contribution plans come in many stripes, but they mostly function like the traditional 401k-style accounts, well known in the private sector.

Shifting the investment responsibility onto the employees is problematic. Most employees are not trained investors and lack experience and knowledge about making optimal investment decisions. It is common that these defacto investors shape their approach by:

- Taking no action: Whether driven by decision fatigue or ignorance, this often results in missed opportunities.

- Guessing: Going on what they’ve heard can result in risky, concentrated, or unsuitable positions, or poor performance from hidden fees.

- Making emotional rather than goal driven decisions: Being impulsive or short-sighted about your retirement plan can result in an overly risky or risk-averse investment.

- Consulting a trusted friend or family member: These results are uncertain, as they depend upon the experience or the suitability of the confidant’s perspective.

Fortunately, a solution has emerged over the years to help employees purposefully invest their employer retirement account, and it works surprisingly well.

The Employee Target Date Fund Solution

Target date funds, also known as lifecycle or retirement date funds, are designed to be a one-stop solution for investors, which automatically adjusts the asset allocation over time based on your retirement goals. Target date funds are available for state of Alaska employees who participate in define contribution plans with Empower. The TDF options range range from the Alaska Target Date Retirement 2010 Trust for retirees to the Alaska Target date Retirement 2065 Trust for the youngest members of the PERS and TRS plans.

Simple and convenient

Target date fundss are relatively simple to use, making it easy for investors to ‘set and forget’ their investment strategy. Little advice is necessary to make a suitable selection. Investors can choose a fund with a target date closest to their expected retirement date, eliminating the need for complex decision making about asset allocation and rebalancing.

Continued realignment with your goals

Target date funds automatically and gradually shift from a more aggressive to a more conservative asset allocation as the target date approaches. This systematic risk management helps advisors stay aligned with their long-term retirement goals, without succumbing emotionally to market fluctuations. Although target date funds can be applied for other goals, they are most commonly used in retirement accounts, aligning the employee investor with their long-term goal of saving for retirement within their employer retirement plan.

Optimize performance

Target date funds optimize performance by being widely diversified and rebalanced to the target mix of stocks and bonds on a regular basis. Changes in asset values lead to shifts in weightings. Rebalancing aims to realign the portfolio with its original asset allocation, ensuring consistency with your retirement financial goals. By adjusting the weights based on returns, automatic rebalancing optimizes the portfolio for long-term performance.

Prevent emotional responses

Aligning your retirement goals with a single investment fund can help investors stay focused on broader financial goals and resist the temptation to make short-term, emotionally driven investment decisions. Investing in target date funds prevents investors from being impulsive and trying to time the market. Market timing is trying to predict the best time to buy or sell an investment and it can lead to poor investment outcomes. Instead, the professional fund manager handles asset allocation adjustments based on a predetermined schedule.

Professional Management

Target date funds are managed by financial professionals who make decisions based on the fund objectives. Professional fund managers have the experience to make informed decisions about the appropriate asset allocation for each stage of an investor’s life. They monitor, practice due diligence, research, develop communications, and follow regulations to ensure effective management and alignment with the fund’s objectives.

Target Date Funds Don’t Work in Every Scenario

Target date funds are an effective investment tool for both an experienced and inexperienced investor saving for retirement in their employer plan. But there are certain situations that require some attention.

Be aware what retirement date you select for your target date fund if your retirement spending goal isn’t the same as your retirement date. For instance, if you intend to use these funds sooner than your retirement date, such as to supplement your child’s college expenses, you might need to select an earlier retirement date. Likewise, if you don’t anticipate needing these funds until much later into retirement, consider selecting the fund date that matches the time period for the distributions.

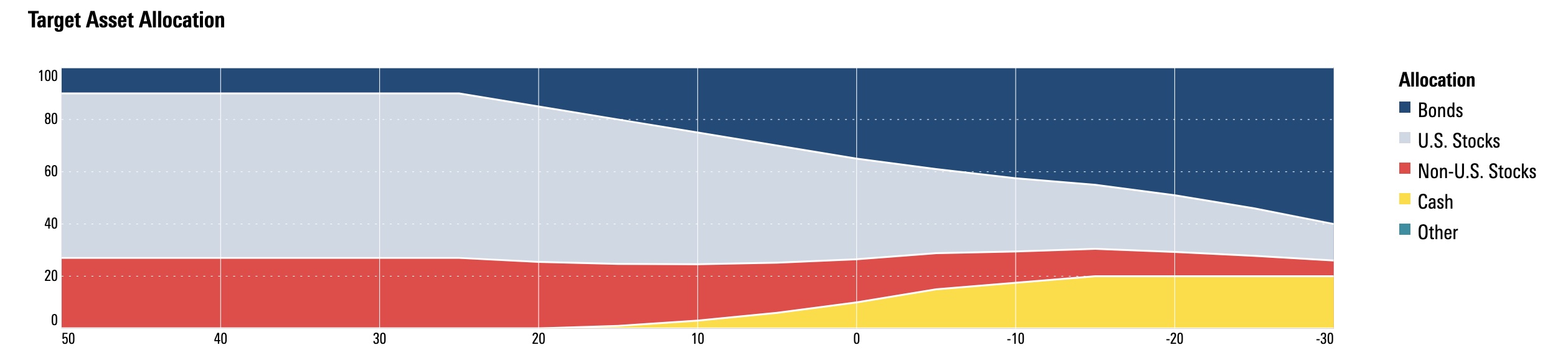

Consider if it is time to adjust your target date funds approach if you are preparing to leave or if you have already left employment. Although it varies by fund, these funds often drift more heavily conservative and continually increase allocation of bonds and cash over time, as shown in glide path below or in this example Alaska Target Date Retirement 2035 Trust prospectus.

Source: 2035 Alaska Target Date Retirement Fund Trust Prospectus – Empower

A retirement fund that is heavily invested in cash and bonds may not be at all appropriate for your retirement goal or situation. How aggressively or conservatively you should invest depends on many factors, such as other sources of guaranteed or variable income, your expected life span, and your goals beyond monthly income, such as end-of-life care or a legacy for your heirs.

Making Maximum Use of Target Date Funds

Target date funds are an effective solution if your goal for these defined contributions accounts is your retirement date and If retirement is still several years away. Remember to select a fund with a date that aligns with when you plan to start making withdrawals from your retirement account. But one size does not always fit all. If you are approaching or in retirement, reach out to Frontier Financial Planning so we can help you to take into account your bigger financial independence picture and to help you ensure that these funds can sustain your desired income in retirement.

Schedule a call today and ensure your retirement is secure.

Stop guessing. Start planning.