Should You Turn Your HSA into a ‘Medical IRA’?

Health Savings Accounts (HSA) offer a great tax-efficient option for paying your current qualified medical expenses. If you participate in an eligible high deductible healthcare plan (HDHP) and are contributing to an HSA, you might already know this. Something you may not be aware of, however, is that you can leverage this tax-advantaged vehicle well beyond the current year medical expenses.

HSA accounts help people who have HDHPs pay for out-of-pocket medical expenses. While these accounts have been available since the early 2000s, too few eligible Americans are taking advantage of them.

HSA: Spending or Investment Account?

By its nature, the best use of an HSA is as an investment vehicle that gives your money a chance to grow. What makes it so special is that the money that you contribute to it goes in tax-free, it grows tax-free when invested, and its distributions are tax-free when used on qualified medical expenses.

I still recall the time that I discovered this. In 2014, as I was starting out in the financial planning space, I remember reading in depth about my husband’s HSA through his employer.

The people I knew who were contributing to an HSA at that time were using it as a spending account for their qualified medical expenses. This is similar to how you may think of using a Flexible Spending Account (FSA). Understandably, this was further reinforced by employers who were just trying to build HSA awareness and participation as an alternative to the FSA for medical expenses. While both HSA and FSA allow you to take a tax-deduction on the money you put into them, HSA money is yours forever and doesn’t expire at the end of the year like FSA money.

After researching the subject, I soon discovered that my husband could elect to invest his tax-free contribution to the HSA, allowing it to grow tax-free. In this way, HSAs function very similarly to a Traditional Individual Retirement Account (IRA). You can use the magic of compounding interest to grow your account for future qualified medical expenses.

Importantly, if you later distribute these invested funds and spend them on qualified medical expenses, you won’t pay taxes on the distributions either. This characteristic is unique to a Roth IRA, which is also distributed tax-free.

For people who find themselves in the fortunate circumstance of not needing to pay for medical expenses in retirement or needing additional retirement funds, your HSA can be used for general non-medical purposes, without penalty, once you reach age 65. Any withdrawn funds used for non-medical purposes are still subject to income taxes, just like your traditional IRA or 401(k).

What this means is that HSAs are kind of a unicorn among investment vehicles because they have the potential to offer triple tax benefits, unrivaled by any other tax-qualified account currently offered in the United States.

It is worthy of consideration for anyone who is eligible to have one.

Why should I invest my HSA contributions for the future?

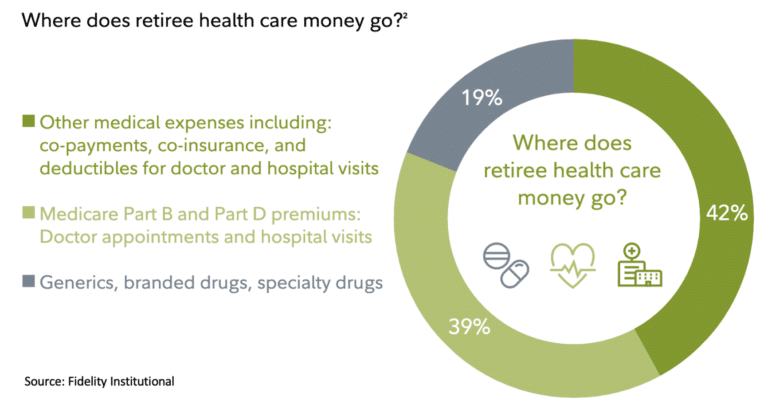

Health care is expected to be one of your largest expenses in retirement, after housing and transportation. Fidelity Institutional estimated in 2020 that the average couple will need almost $300,000 to cover medical expenses in retirement, excluding long-term care. The leading use of money for medical care went to medical expenses; however, the cost of funding Medicare Part B and D premiums wasn’t far behind.

There is a good chance your medical expenses will be greater in retirement than they are now. Be sure to weigh the benefits and costs of investing at least a portion of your HSA for retirement.

How Do I Qualify for an HSA if I Don’t Already Have One?

Like employer retirement plans and IRAs, there are rules about who can open and contribute to an HSA. You must meet several requirements, the most important being that you must be covered under a qualifying high-deductible health plan (HDHP).

Does your employer offer a qualifying high-deductible health care plan and HSA account as part of your available benefits? If you have individual insurance, the Marketplace Health Plans offer HDHP options that qualify for HSAs as well. An HDHP may be the right fit for you if you and your family are healthy and rarely get sick or injured.

How Does Contributing to and Investing my HSA Save Me Money?

By enrolling in an HDHP, you are likely to pay a lower monthly premium but have a higher deductible. The premium is what you pay upfront, often directly from your employer paycheck, while the deductible are your expenses on health care items and services before the insurance plan pays.

If you don’t typically pay much toward health care expenses, you may benefit from a lower monthly premium. Although you would be expected to pay a higher deductible, paying these expenses from an HSA are tax-free. The tax-free savings adds up quickly when compared to paying for medical expenses directly from your earned income, which is taxed as ordinary income.

The HSA balance rolls over every year allowing you to invest any unused HSA funds. The best way to take advantage of the triple tax advantage is to treat it as an investment tool that will improve your financial picture in retirement. Compounding and capital appreciation of this tax-free investment will grow your HSA account time for much needed medical expenses in retirement, saving you more money in the long-run.

Benefits of a ‘Medical IRA’

It has been ingrained in us to contribute to our employer 401(k) or IRAs as the best way to save for retirement. It’s time you started using your HSA the same way and leverage the tax-opportunities for retirement medical expenses.

HDHPs don’t make sense for everyone. For instance, parents with children that have chronic conditions versus those who barely see the doctor in a year, have to weigh the pros and cons differently.

Are you wondering if an HSA is appropriate for you and your family? I understand that these choices can’t be made in a vacuum and depend on your unique situation. I’ve been through it with my family and many others and can help you as well. Schedule time with me so we can discuss your situation.